Measuring Investor Sentiment

Why the Sentiment King?

Before you subscribe please watch these short videos.

Warren Buffett said: “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.” Notice he didn’t say, “interest rates” or “earnings”, just emotions. This is what makes investing so hard; you must buy when things look bleak, then sell and walk away when the future looks bright and everyone’s making a killing. The Sentiment King is dedicated to helping investors do this.

The Sentiment King is for professional money managers and private investors who know the importance of “market sentiment” when making their investment decisions. History shows that 50%, or more, of an asset’s price is driven by investor emotion, not economic factors. The Sentiment King provides objective reports that monitor what investors are thinking, feeling, and doing in three markets – the stock market, the bond market, and the gold market.

Before you subscribe please watch these short videos.

Warren Buffett said: “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.” Notice he didn’t say, “interest rates” or “earnings”, just emotions. This is what makes investing so hard; you must buy when things look bleak, then sell and walk away when the future looks bright and everyone’s making a killing. The Sentiment King is dedicated to helping investors do this.

The Sentiment King is for professional money managers and private investors who know the importance of “market sentiment” when making their investment decisions. History shows that 50%, or more, of an asset’s price is driven by investor emotion, not economic factors. The Sentiment King provides objective reports that monitor what investors are thinking, feeling, and doing in three markets – the stock market, the bond market, and the gold market.

The Sentiment King

Dynamic Allocation of Stocks, Bonds and Gold Based on Indicators of Investor Sentiment

The Master Sentiment Indicator Reports

This report is based on a composite indicator made from nine established sentiment indicators. It now includes the bond and gold reports at no additional charge.

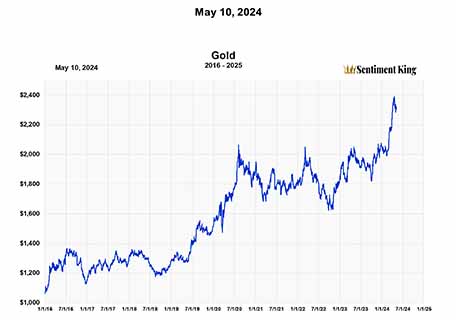

The Gold Report

This report is based primarily on two proprietary gold sentiment indicators – one for the short to intermediate-term and one for the long-term.

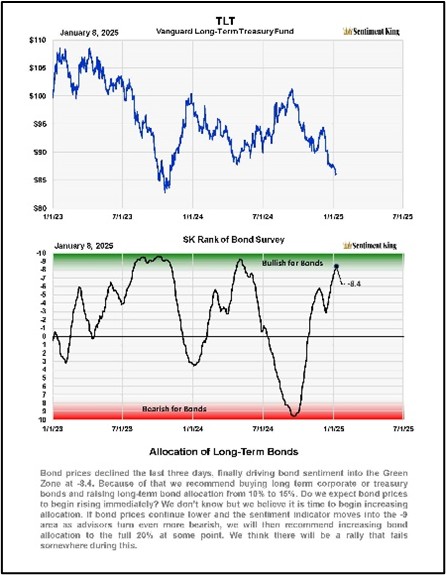

The Bond Report

This report is based primarily on bond market sentiment. It is now included with a subscription to the weekly MSI report.

The Top 100 “Puts to Calls” Report

More information coming soon.