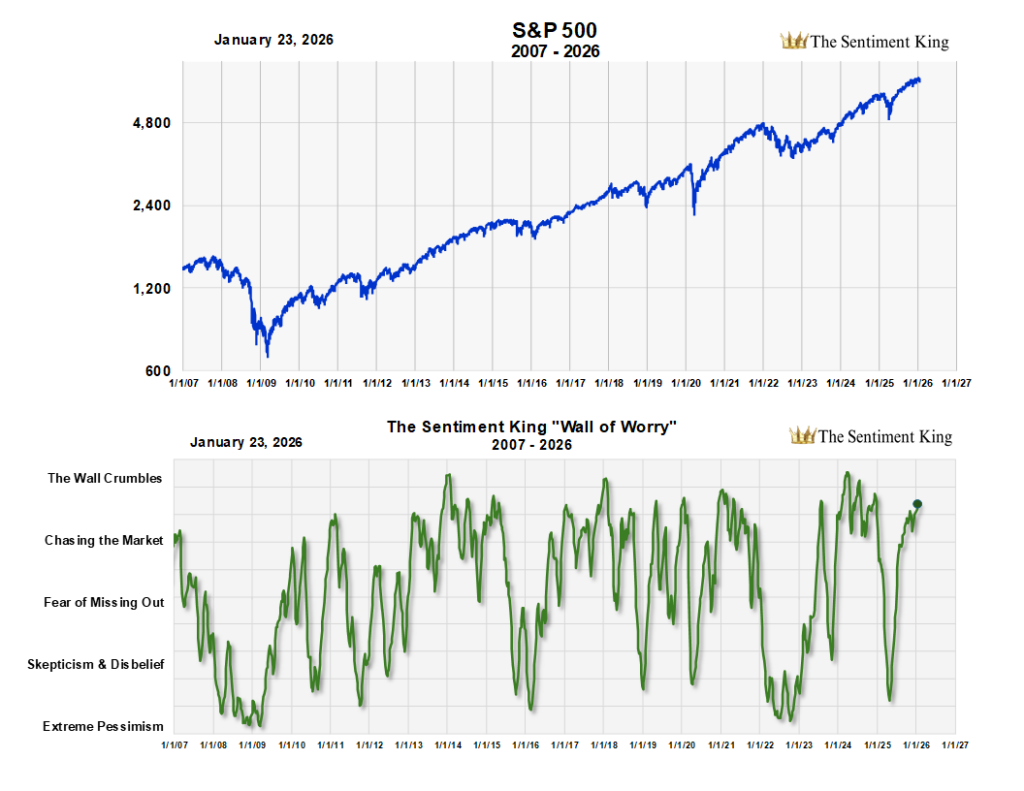

The "Wall of Worry"

First mentioned in the 1950s, the term “Wall of Worry” refers to something very specific. It describes how major advances almost always rise into the face of worry and disbelief, with investors thinking the rally can’t continue.

The WOW proceeds through five stages:

Extreme Pessimism: At a major market low, most investors fail to invest due to extreme worries about the economy and/or geopolitical events.

Skepticism and Disbelief: Any rally is met with inaction and disbelief; many thinking it’s a “bull trap” that will fail.

Fear of Missing Out: As markets continue to climb, some investors begin to worry about “missing out.” They start buying, and this buying pushes prices even higher.

Chasing the Market: When prices move even higher, the “left behind” investors begin to panic and “chase” the market.

The Wall Crumbles: Finally, the “Wall of Worry” crumbles. Optimism replaces any remaining worry, and investors now agree that prices will continue higher. They won’t, at least not like they were.

The Sentiment King “Wall of Worry” is based on combining five indicators that measure investor expectations:

1.The Investors Intelligence Survey of Newsletter Writers

2.The AAII Survey of Members

3.The Hulbert Stock Market Survey

4.The Hulbert Nasdaq Survey

5.Investment Posture of Active Money Managers