About

The Sentiment King is for professional money managers and private investors who know the importance of “investor sentiment” when making investment decisions. Through proprietary indicators we monitor investor expectations in three markets – the stock market, the bond market, and the gold market.

Warren Buffett said: “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.” Notice he didn’t say, “interest rates” or “earnings”, just emotions. This is what makes investing so hard; you must buy when things are scary, then sell and walk away when the future looks bright and investors are happy. The Sentiment King is dedicated to helping investors do this.

Michael James McDonald is founder of The Sentiment King. He is a stock market forecaster, author and former Senior Vice President of Investments at a company that’s now part of Morgan Stanley, where he managed over $500 million. He is a long-term advocate of the theory of contrary opinion and the measurement of investor expectations when forecasting price direction.

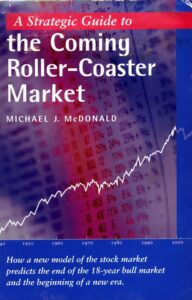

His first book, ” A Strategic Guide to the Coming Roller Coaster Market” was published in June of 2000, three months before the top of the dot comm bubble. On its cover was written, “How a new model of the stock market predicts the end of the 18-year bull market (1982-2000) and the beginning of a new era.” The “new era” was to be a long-term (roller coaster) trading range market, which did materialize between 2000 and 2009.

Then, on August 31st, 2010, in a SeekingAlpha article titled: “The 10 Year Trading Range Is Over – The ‘Final Stampede’ Has Begun”, he called an end to this trading range market and the beginning of another long-term bull market, which also came about.

Through his company The Sentiment King, he continues to study and do what he loves – research and attempt to successfully forecast major stock trends – and help others see them too.

The Sentiment King is for professional money managers and private investors who know the importance of “investor sentiment” when making investment decisions. Through proprietary indicators we monitor investor expectations in three markets – the stock market, the bond market, and the gold market.

Warren Buffett said: “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.” Notice he didn’t say, “interest rates” or “earnings”, just emotions. This is what makes investing so hard; you must buy when things are scary, then sell and walk away when the future looks bright and investors are happy. The Sentiment King is dedicated to helping investors do this.

Michael James McDonald is founder of The Sentiment King. He is a stock market forecaster, author and former Senior Vice President of Investments at a company that’s now part of Morgan Stanley, where he managed over $500 million. He is a long-term advocate of the theory of contrary opinion and the measurement of investor expectations when forecasting price direction.

His first book, ” A Strategic Guide to the Coming Roller Coaster Market” was published in June of 2000, three months before the top of the dot comm bubble. On its cover was written, “How a new model of the stock market predicts the end of the 18-year bull market (1982-2000) and the beginning of a new era.” The “new era” was to be a long-term (roller coaster) trading range market, which did materialize between 2000 and 2009.

Then, on August 31st, 2010, in a SeekingAlpha article titled: “The 10 Year Trading Range Is Over – The ‘Final Stampede’ Has Begun”, he called an end to this trading range market and the beginning of another long-term bull market, which also came about.

Through his company The Sentiment King, he continues to study and do what he loves – research and attempt to successfully forecast major stock trends – and help others see them too.